On 9 September 2014, Wilson Prichard, Assistant Professor at the Munk School and Research Director of the International Centre for Tax and Development (ICTD), played a critical role in formally launching the ICTD Government Revenue Dataset at a high-level event organized in partnership with the Centre for Global Development in Washington, DC.

Over the last decade, the issue of taxation and development has been a growing area of interest for researchers and policymakers, though the unreliability of available government revenue data had served as a major obstacle to cross-country research.

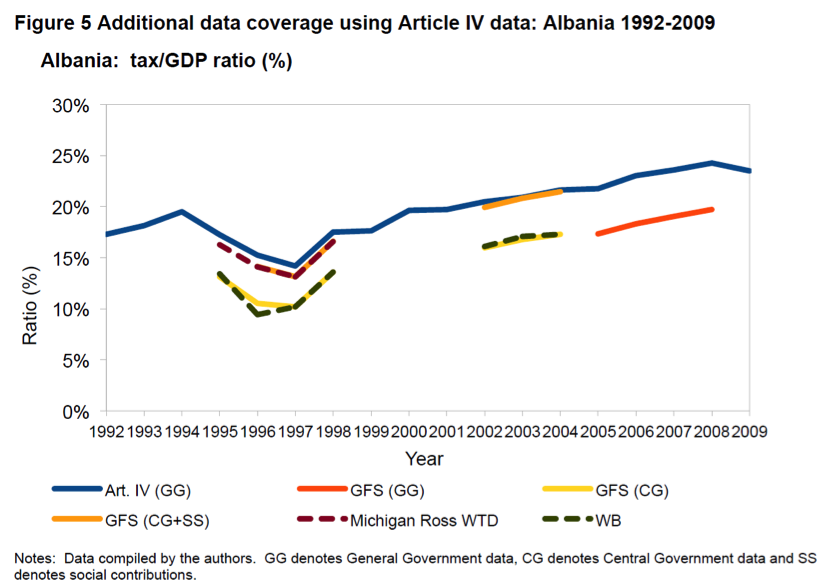

Aiming to address this, the GRD, the culmination of a 3-year project, is a composite dataset that has compiled and harmonized numerous existing datasets from various sources, improving both the longitudinal coverage and quality of government revenue data. It represents the largest, most complete, and most accurate dataset on government revenue, covering a period of up to 30 years for almost 200 countries. An important contribution of the dataset is its reconciliation of cross-country differences in the recording of natural resource and social security revenues, making cross-country comparisons more reliable.

This ambitious endeavour was made possible with the work of MGA alumnae Vanessa van den Boogaard (MGA 2012), Fariya Mohiuddin (MGA 2012), and Ava-Dayna Sefa (MGA 2012). All of the details of the creation of the new dataset and an outline of its key features are included in an ICTD Working Paper authored by Prichard, Alex Cobham and Andrew Goodall.

Researchers have been keen to make use of the dataset in order to test key theories in the tax and development field. For instance, using the dataset, Prichard, Paola Salardi, and Paul Segal confirm the existence of a political resource curse, while Kyle McNabb and Philippe LeMay-Boucher shed new light on the growth impact of tax structure. A central theory in the literature of tax and development is that foreign aid flows decrease incentives for governments to tax. However, Oliver Morrissey, Prichard, and Samantha Torrance are unable to replicate the findings of previous literature on aid and tax using the GRD, concluding that there is “no evidence to justify claims that grants reduce tax effort.” Likewise, Paul Clist tests theories of tax and aid, finding “a modest but positive effect from foreign aid on domestic tax revenue.”

As Prichard, Cobham and Goodall conclude in their working paper: “The benefits of the new ICTD Government Revenue Dataset are, we think, substantial: irrespective of minor imperfections, the ICTD GRD provides both researchers and policymakers with a dataset that is dramatically more complete and more accurate than existing options. This in turn, stands to provide a much more reliable foundation for research, while (...) providing a much clearer picture of historical patterns of tax collection.”

The new ICTD Government Revenue Dataset is now publicly available, accessible via the ICTD website (http://www.ictd.ac). Presentations from the seminar launch and working papers based on this new dataset are also available.